Demand Destruction is Looming Large

The climax of an immense monetary binge

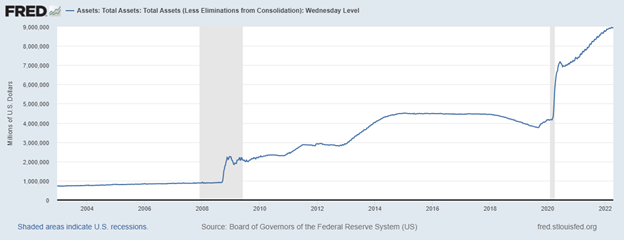

The US economy is in the final stages of a demand climax caused by a decades-long increase of the money supply, and systematic suppression of interest rates. We’ve seen fifteen (15) years of the Fed buying trillions in US Treasury Bonds and Mortgage-Backed Securities (MBA) using money literally created from nothing. Add the trillions distributed in direct fiscal subsidies to the US consumer’s pocket from Treasury since the Great Financial Crisis (GFC) in 2008. It’s easy to see how the Fed has added over $8T (USD) to the US Federal Balance Sheet in just 13 years. This has been a massive monetary expansion, given the size of the Federal Reserve Balance Sheet was under $1T (USD) in late 2008. That’s an 800% increase in assets held by the Fed since 2008.

The value of assets held by all Federal Reserve Banks as at April 2022 is $8.965T:

Figure 1

Combine the fantastic increase in the size of the Fed balance sheet with the Fed suppressing the Federal Funds Rate to near zero since 2008:

Figure 2

As the largest buyer of Treasury debt, and having held interest rates near zero, the Fed has driven public debt from 60% of GDP in 2008 to almost 140% of US GDP in 2022. Sales of Treasury debt to the Fed represent interest free loans for Treasury. The Fed returns all interest paid by Treasury, every year, after paying its operating expenses and stockholder dividends:

Figure 3

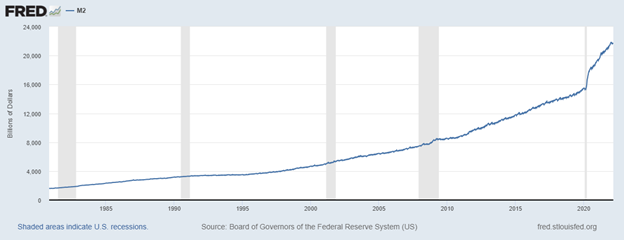

The Fed’s balance sheet expansion was based on money created from nothing. Therefore, Fed asset purchases have resulted in increasing the money supply (M2) by 260% since the end of 2008:

Figure 4

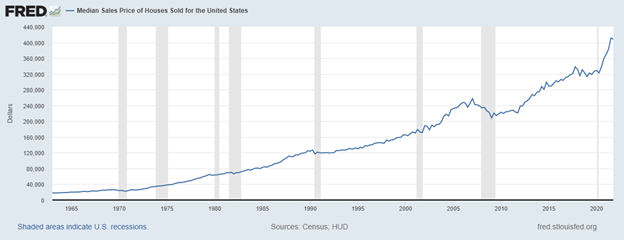

While price rises have been meteoric, traditional asset classes simply haven’t been large enough to soak up all the demand arising from a 260% spike in M2. The Median Sales Price of homes in the US increased by over 100% from December 2008:

Figure 5

As a result, owner’s equity in US real estate increased by 250% from December 2008:

Figure 6

Investors poured trillions into the growth miracle of NASDAQ tech stocks with the index climbing 970% since 2008, minting tens of thousands of new millionaires. This was almost the same rate of growth as the Federal Balance Sheet itself, over the same period:

Figure 7

The S&P 500 index has grown 363% since 2012:

Figure 8