We Engage

Total System Effectiveness

(TSE)

The truth confronting all managers and board members today is that survival depends upon Return on Invested Capital (ROIC) rising above the Cost of Capital (WACC). Until it does, debt and equity are destroyed to pay the cost of capital. That's unsustainable.

As monetary policy tightens around the globe, the cost of capital is rising. The urgency to improve ROIC is increasing exponentially.

Increasing ROIC requires a balanced focus on reducing both fixed and variable expenses, as well reducing invested capital. Many management systems fail to demand this balanced focus. Because capital has been historically cheap for two (2) decades, efforts to control Capacity Utilization (CU) have languished. Generating shareholder returns has been more about sacrificing operating profit to sustain revenue growth than increasing operating profit.

Consequently, many organizations have all but ignored fixed costs and haven't recognized the risk associated with bloated balance sheets. It's common for managers to deny responsibility for past decisions to acquire excess production capacity. Historical investment in excess capacity is often simply shrugged off as 'sunk cost'. This has resulted in fixed costs and invested capital having no real owner in the governance structure.

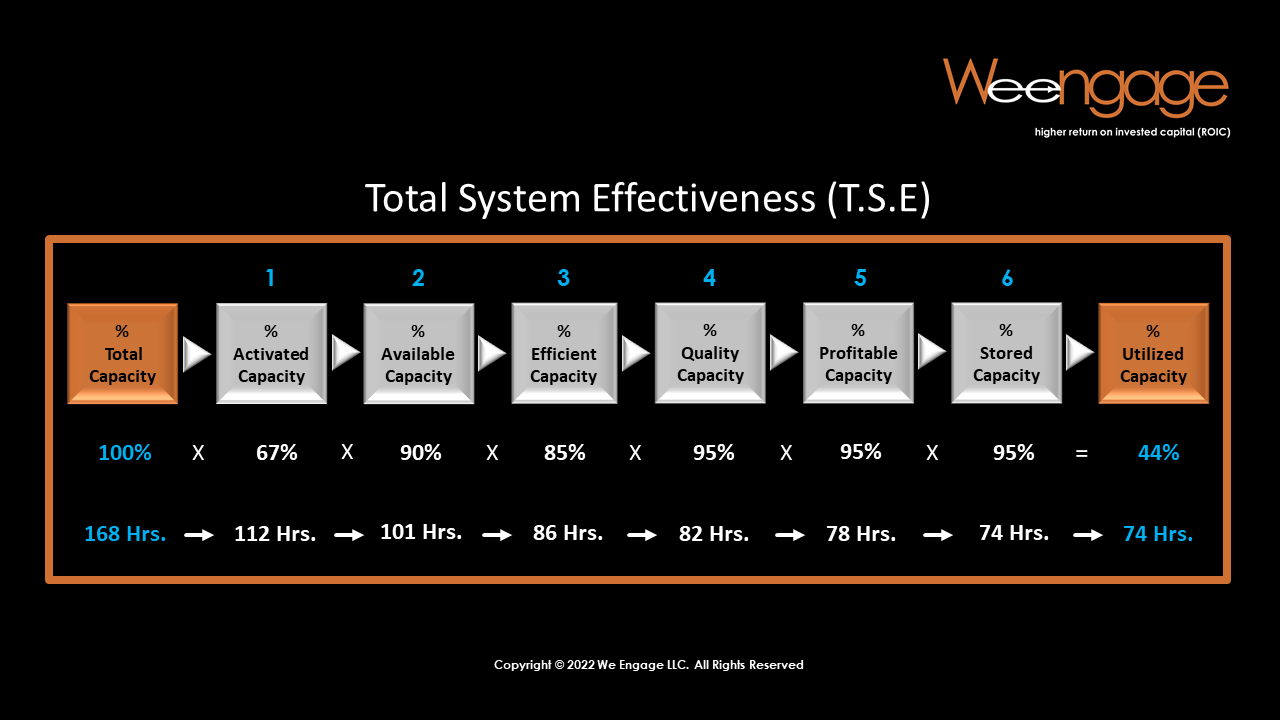

Total System Effectiveness (TSE) is a composite performance measure which measures true capacity utilization and highlights the causes of lost productive capacity. TSE establishes a concurrent focus on both the gross and operating margins, as well as excess invested capital (debt & equity). This allows management to take control of ROIC and the Economic Spread (ES).

We Engage

Integrating Economic &

Operational Performance

Two decades of accommodative monetary policy has biased management systems against the management of Fixed Costs and Invested Capital, and towards Revenue growth at the expense of Operating Profit. Stock markets have rewarded increased growth and market share. This has been funded with cheap debt and easy equity rather than Net Income. The strategy du jour has been 'Get Big Fast'.

If an organization wants to improve ROIC, it must reduce Fixed Costs and Invested Capital while increasing profitable demand. That requires a rebalance of performance reporting and review towards true Capacity Utilization (CU). The game is changing.

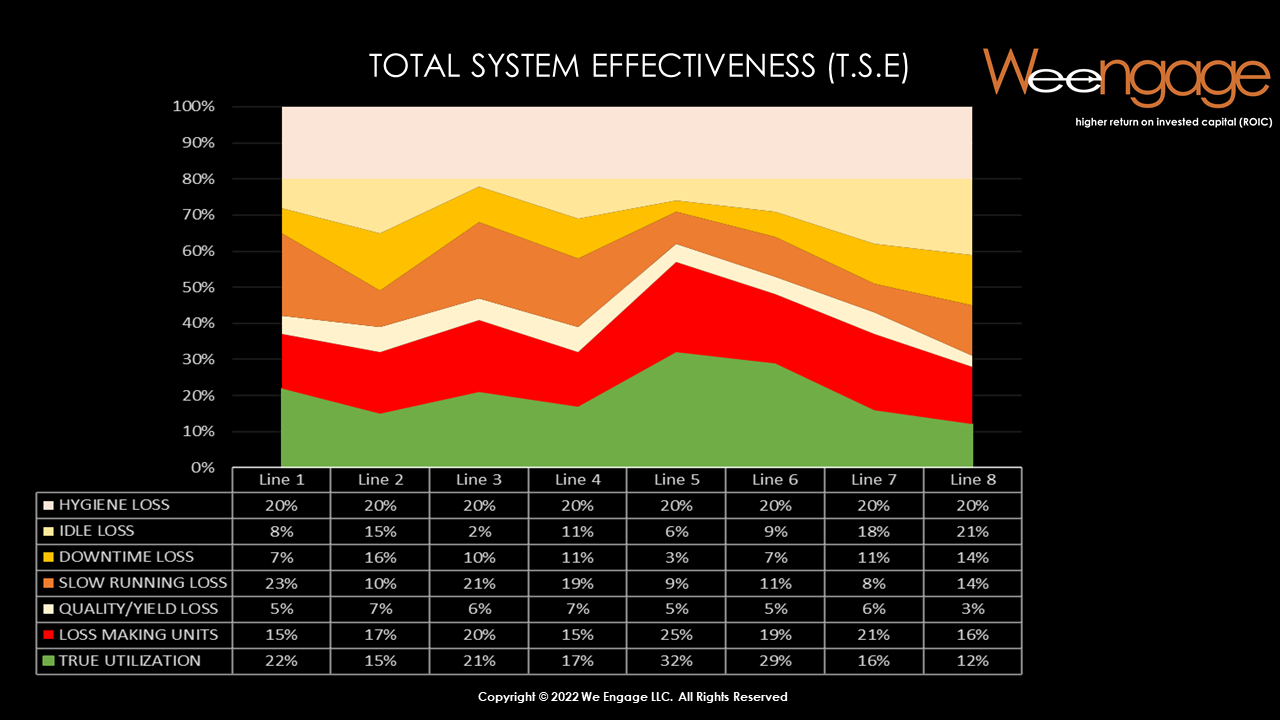

The chart above is a typical visual representation of weekly Total System Effectiveness (TSE). The green band at the base is the percentage of productive capacity which has been utilized to satisfy customer demand (by production lines 1-8). Currently, it's not uncommon for companies to utilize only 25% of their productive capacity. The other bands on the chart show how the 75% balance of productive capacity has been destroyed during the period.

TSE corrects the bias against managing productive capacity. Every function will make specific commitments to introduce the changes necessary to recover lost capacity in one or more of these bands of performance.

Our programs provide the foundation to recover and remove as much as 50% or more of wasted capacity within 20 to 40 calendar weeks.

We Engage

Line of Sight

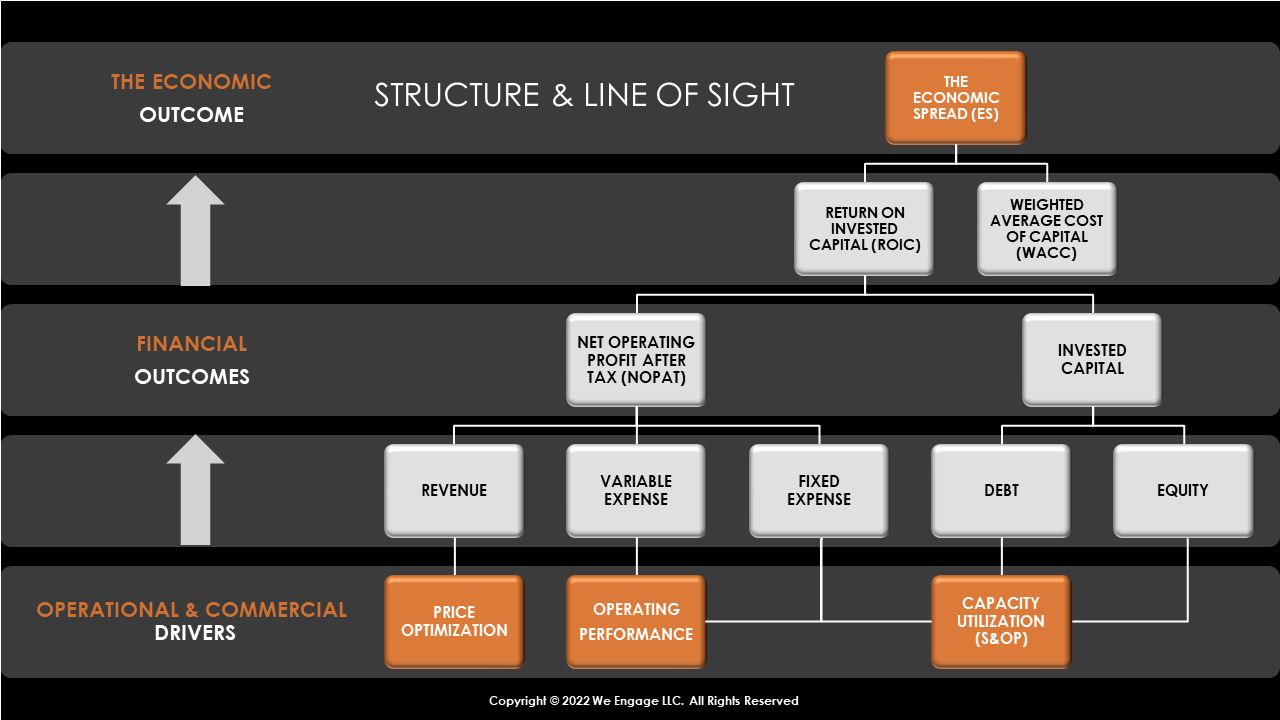

Another problem which hobbles progress towards changing the focus of operating systems is that the operations function and the financial function have two entirely different technical and performance dialects. The terminology and jargon of the Finance and Accounting function is completely opaque to many operations managers and much of the technical jargon used in production functions is opaque to many in Finance.

Operational performance outcomes drive most financial outcomes and every organization must have clarity concerning which operating performance measures need to move in order to produce the desired financial outcomes. Both functions need to be engaged in a mutual performance dialogue at all times. Instead, Finance and Operations are often cloistered and disengaged with one or the other being led around by the ring in its nose regarding the focus of improvement.

Our programs establish clear line of sight between the performance measures which need to change in an operational context and the targeted improvement in financial and economic outcomes. The reporting and review process surrounding TSE established a balanced, peer to peer review process which engages all key functions on a weekly basis.